Facts About Hsmb Advisory Llc Revealed

Facts About Hsmb Advisory Llc Revealed

Blog Article

The 5-Minute Rule for Hsmb Advisory Llc

Table of ContentsThe Only Guide for Hsmb Advisory LlcAll about Hsmb Advisory LlcThe Best Guide To Hsmb Advisory LlcThe Main Principles Of Hsmb Advisory Llc Hsmb Advisory Llc - An OverviewHsmb Advisory Llc for DummiesSome Known Details About Hsmb Advisory Llc

Likewise be conscious that some policies can be expensive, and having certain health and wellness conditions when you apply can increase the costs you're asked to pay. St Petersburg, FL Health Insurance. You will need to make sure that you can manage the premiums as you will require to devote to making these settlements if you want your life cover to remain in areaIf you really feel life insurance policy can be useful for you, our collaboration with LifeSearch enables you to obtain a quote from a number of service providers in double double-quick time. There are various kinds of life insurance policy that intend to fulfill different security needs, consisting of level term, decreasing term and joint life cover.

3 Easy Facts About Hsmb Advisory Llc Described

Life insurance coverage gives five financial advantages for you and your household (Life Insurance St Petersburg, FL). The major benefit of including life insurance to your financial strategy is that if you die, your heirs get a round figure, tax-free payout from the plan. They can use this cash to pay your final expenditures and to replace your income

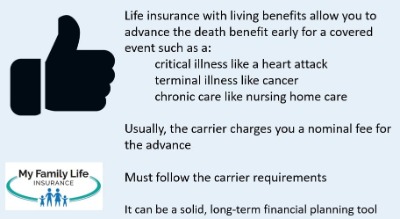

Some plans pay out if you develop a chronic/terminal illness and some give savings you can utilize to support your retirement. In this article, find out about the numerous benefits of life insurance policy and why it might be a great concept to purchase it. Life insurance policy provides advantages while you're still alive and when you pass away.

Some Known Facts About Hsmb Advisory Llc.

If you have a policy (or plans) of that size, individuals that rely on your revenue will certainly still have money to cover their continuous living expenditures. Recipients can utilize policy advantages to cover essential daily costs like rental fee or home loan payments, utility expenses, and grocery stores. Typical annual expenses for households in 2022 were $72,967, according to the Bureau of Labor Stats.

Hsmb Advisory Llc for Beginners

Furthermore, the money worth of whole life insurance grows tax-deferred. As the money worth develops up over time, you can use it to cover costs, such as getting an automobile or making a down repayment on a home.

If you determine to obtain versus your money value, the car loan is not subject to income tax as long as the plan is not given up. The insurance policy company, nonetheless, will certainly charge passion on the lending amount up until you pay it back (https://sandbox.zenodo.org/records/44764). Insurance coverage companies have varying rates of interest on these loans

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

For instance, 8 out of 10 Millennials overstated the price of life insurance in a 2022 research. In reality, the typical expense is closer to $200 a year. If you believe spending in life insurance policy may be a clever economic move for you and your household, consider consulting with a monetary advisor to embrace it into your economic plan.

The five major types of life insurance coverage are term life, whole life, universal life, variable life, and final expenditure insurance coverage, likewise understood as funeral insurance. Entire life begins out setting you back more, yet can last your entire life if you maintain paying the costs.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

It can pay off your debts and clinical costs. Life insurance might likewise cover your mortgage and give cash for your household to keep paying their bills. If you have family members depending upon your revenue, you likely need life insurance policy to sustain them after you pass away. Stay-at-home parents and entrepreneur also typically need life insurance policy.

For the many component, there are two types of life insurance policy prepares - either term or long-term plans or some combination of both. Life insurers offer various types of term plans and typical life policies as well as "interest delicate" products which have actually come to be extra common considering that the 1980's.

Term insurance supplies security for a specific period of time. This duration could be as brief as one year or supply coverage for a details number of years such as 5, 10, twenty years or to a specified age such as 80 or sometimes as much as the earliest age in the life insurance coverage mortality.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

Currently term insurance rates are very competitive and amongst the most affordable historically knowledgeable. It needs to be noted that it is a widely held idea that term insurance policy is the least expensive pure life insurance policy coverage available. One needs to evaluate the policy terms meticulously to choose which term life alternatives are suitable to fulfill your particular situations.

With each brand-new term the premium is enhanced. The right to restore the policy without proof of insurability is an essential advantage to you. Otherwise, the threat you take is that your health might weaken Source and you may be incapable to obtain a policy at the very same rates or perhaps in any way, leaving you and your recipients without coverage.

Report this page